Now what?

As investors, we always have that question on our minds.

Last year, cannabis enjoyed an epic rebound. After two brutal years of the longest bear market in the nascent industry’s history, shares surged to all-time highs.

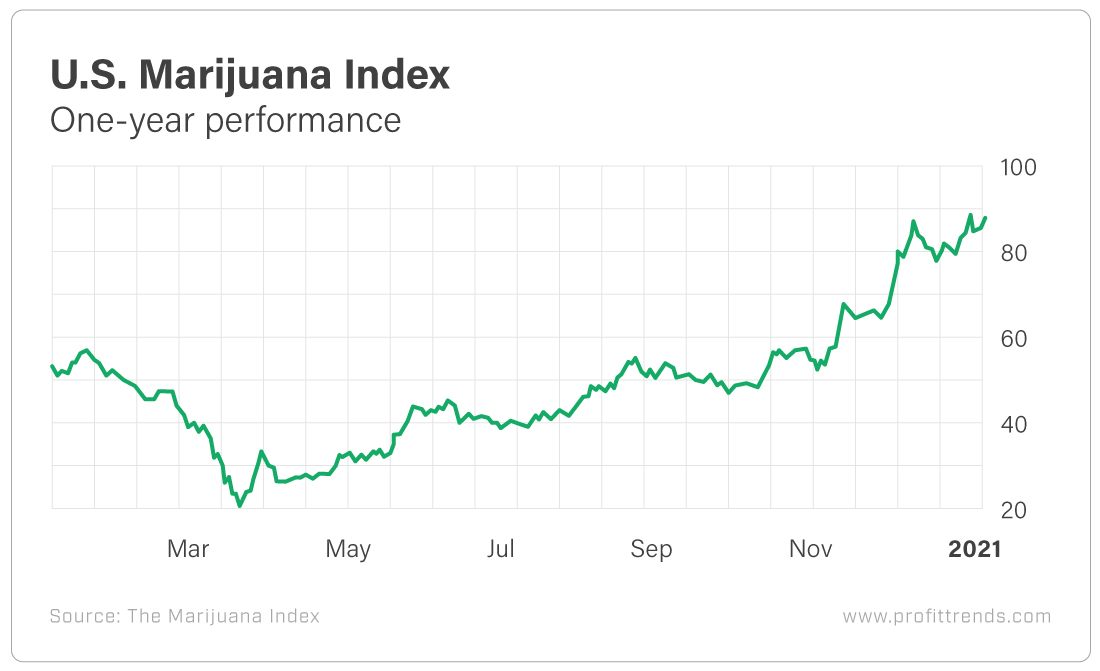

The U.S. Marijuana Index outpaced the broader indexes by a significant margin, gaining more than 61% last year.

Admittedly, that outperformance fails to capture just how massive the turnaround for this industry was. From its March lows, the index rocketed more than 313% higher to close out 2020.

And individual companies put even that surge to shame. Sure, U.S. multistate operators (MSOs) Curaleaf Holdings (OTC: CURLF), Green Thumb Industries (OTC: GTBIF) and Trulieve Cannabis (OTC: TCNNF) saw their shares more than double.

But Jushi Holdings (OTC: JUSHF) – which we spotlighted here – saw its shares soar more than 360%. And my No. 1 small cap for 2020, GrowGeneration (Nasdaq: GRWG), saw its shares increase nearly ninefold!

It was a historic year for American cannabis…

So the question remains… Now what?

The Push for Kush

I’ve long forecast that the American cannabis industry would be worth approximately $80 billion by the end of the decade.

And from where we stand now, that estimate might be conservative.

After a clean sweep on Election Day – one of the only undisputed victories of this election – the U.S. now has 15 states that allow for adult-use and 36 that allow for medical use.

But don’t expect that to be the end for legalization.

I want to reiterate that as many as a half-dozen states could debate expanded legalization this year.

The coasts are filling with recreational markets. Though the East Coast has largely legalized medical use, with the recent recreational approval in New Jersey, I expect this situation to change quite rapidly.

In fact, my home state of Maryland will likely debate adult-use. As will Connecticut, New Mexico, New York, Pennsylvania, Rhode Island and Virginia.

There’s tremendous pressure to recoup tax revenue and provide more jobs due to the economic devastation triggered by the pandemic. That alone will foster an accelerated pace of legalization.

New Highs to Come

I think cannabis is strolling into 2021 on a high.

At the end of 2019, the list of $1 billion MSOs was meager – less than a handful.

By the end of 2020, the list had grown substantially… Curaleaf, Columbia Care (OTC: CCHWF), Cresco Labs (OTC: CRLBF), Green Thumb and Trulieve were all worth more than $1 billion. Then we had others like Ayr Strategies (OTC: AYRWF), Harvest Health & Recreation (OTC: HRVSF), Planet 13 Holdings (OTC: PLNHF) and TerrAscend (OTC: TRSSF) – among others – close in on that level as well.

Business is booming in cannabis, and share prices reflect that.

But for longtime cannabis veterans, we know the biggest cause for caution heading into 2021 is euphoria.

The threat of overheated optimism inflating prices too quickly and the fear of missing out could lead to a bubble.

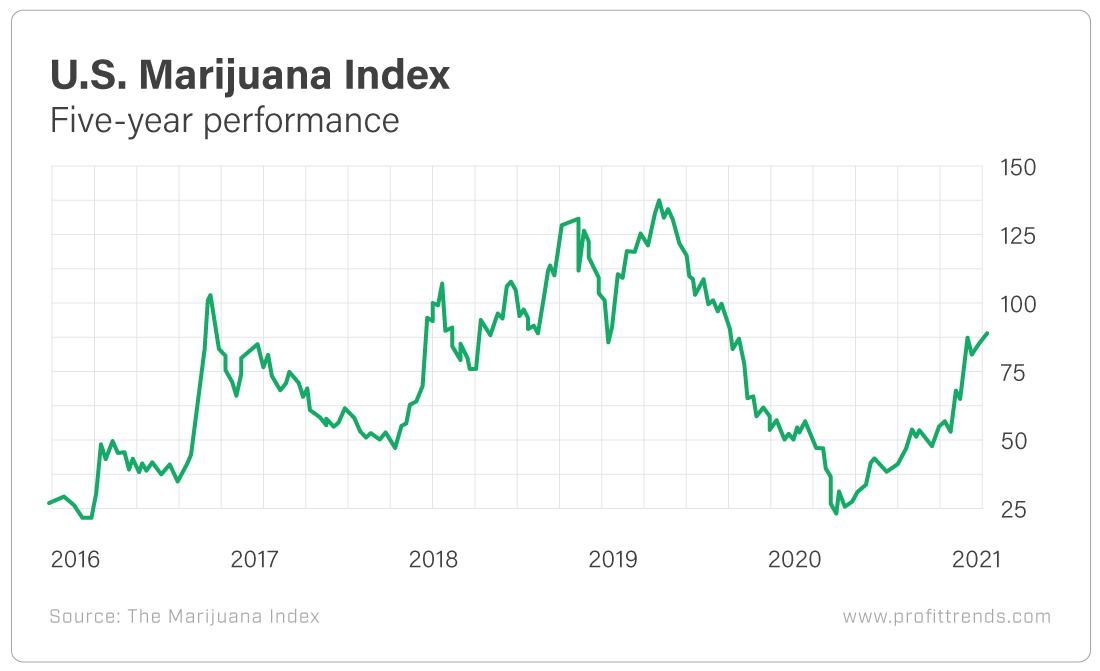

That’s a tale we’ve watched play out multiple times over the years. And we can see that clearly in the peaks and troughs of the U.S. Marijuana Index.

That said, American cannabis companies are still well off the highs set in 2015, 2016, 2018 and 2019.

In fact, the U.S. Marijuana Index would still need to climb more than 53% to reach its April 2019 top. From December 2017 to August 2019, the index traded higher than it does now. And industry sales were nowhere near where they are today.

But this is a time to continue to be selective with your cannabis portfolio. There is no reason to feel like you’ve missed the boat or chase some highly speculative play.

For example, MSOs like Cresco Labs, Green Thumb and Trulieve are reporting more than $100 million in quarterly revenue. And they’ll approach nearly $1 billion in sales this year.

These are numbers investors could hardly fathom when the industry began in 2012.

And Curaleaf is topping them all, reporting more than $200 million in quarterly revenue.

So now what?

Well, it’s a new year, and American cannabis is turning over a new leaf. Companies are reporting not massive losses but surging profits! That’s going to trigger even bigger gains.

It was historic moment after historic moment for the industry this past year. And I expect 2021 will bring even more new highs and more history to be made… So make sure your portfolio is ready!

Here’s to high returns,

Matthew Carr

Chief Trend Strategist

ProfitTrends.com